Graphing Digital Assets

Month in Review — July 2025 | Special Edition: Video Commentary

A special thank you to Carl Szantyr and BlockStone Capital for inviting Samara Alpha CIO, Adil Abdulali, to join an insightful discussion, “Bitcoin at New Highs: Building Risk-Adjusted Portfolios in the Next Market Cycle.” The full replay of the live webinar, recorded on July 25, 2025, may be available upon request. The video clips featured in this Special Edition of our monthly commentary are excerpts from the webinar.

Setting a New Course for Digital Asset Investing

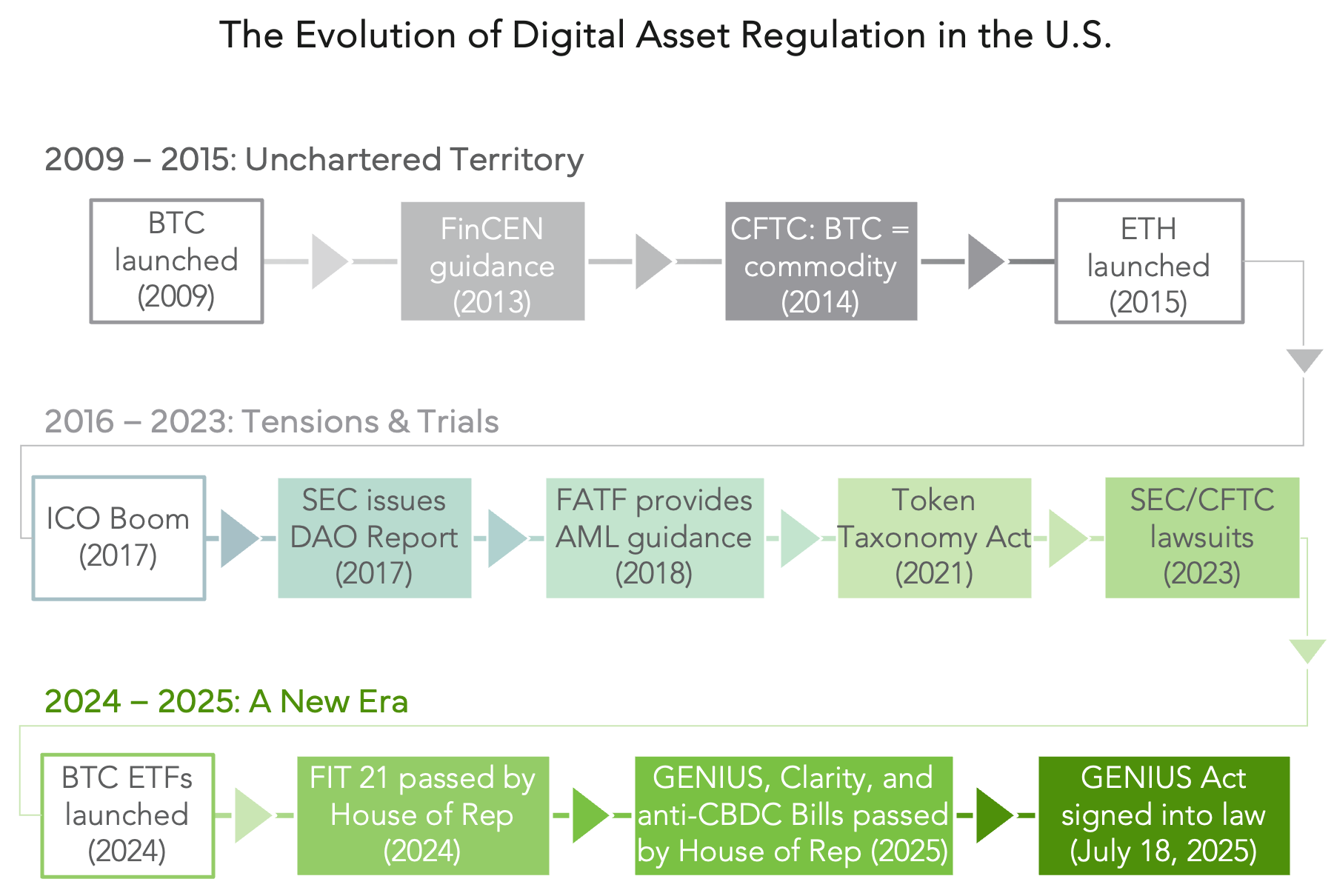

Against a backdrop of historic U.S. dollar depreciation (Fig. 1) and global instability, investor interest in digital assets as alternative stores of value continues to grow. The passage of landmark crypto legislation in July marks a major turning point, capping more than 15 years of regulatory ambiguity in the U.S. (Fig. 2).

Following the signing of the GENIUS Act into law on July 18th, the U.S. Securities and Exchange Commission voted on July 29th to approve orders to allow in-kind creations and redemptions for crypto asset exchange-traded product (ETP) shares. As SEC Commissioner Paul S. Atkins noted, “[These] approvals continue to build a rational regulatory framework for crypto, leading to a deeper and more dynamic market, which will benefit all American investors.”

In this video, Adil explores how this shifting environment sets the stage for broader adoption and innovation throughout the digital asset landscape.

Figure 1

Source: Samara Alpha Management and Yahoo Finance as of July 31, 2025. Bitcoin price reflected in USD terms. Gold represented by GD+F; USD represented by DXY.

Figure 2

Source: Samara Alpha Management and CCN, “History of US Crypto Regulation: From Legal Gray Zones to the GENIUS, CLARITY and Anti-CBDC Acts,” July 18, 2025.

Capital Formation Giving Rise to Growth

The conversation shifts to the evolving mechanics of capital formation in crypto, where decentralized finance (DeFi) is redefining financial infrastructure. Adil contrasts two headline-grabbing raises—Pump.fun’s $1.2B ICO in just 12 minutes and Circle’s $1.1B IPO—highlighting how they tapped entirely different investor bases through radically different mechanisms (Fig. 3).

With liquidity in altcoins historically constrained by regulatory uncertainty, the Clarity Bill could catalyze broader access by defining clear rules for digital asset markets. As DeFi protocols continue to grow (Fig. 4) and replace traditional intermediaries, improved regulatory clarity may accelerate innovation and unlock new waves of investment.

Figure 3

Timeline shown is not in proportion to actual time passed, with shaded green area representing a period of 24 hours or less, as labeled. Source for Circle data: Reuters, “Stablecoin issuer Circle raises $1.05 billion in upsized US IPO,” June 4, 2025. Source for Pump.fun data: CoinTelegraph, “How Pump.fun raised $500M in 12 minutes, and what it says about retail FOMO,” July 25, 2025; and Blockworks.

Figure 4

Source: DeFi Llama as of July 31, 2025.

Institutional Alpha Capture

While institutions are increasingly allocating to digital assets, they remain far outnumbered by family offices and individuals, investors with the most flexible mandates (Fig. 5). Yet despite this growing conviction and the support of clearer regulatory frameworks, the market remains inefficient due to its relatively small asset sizes and limited capital saturation: compared to traditional equities, the market capitalization of all cryptocurrencies still ranks below that of a single large-cap stock like Nvidia or Microsoft (Fig. 6). This makes the space unfit for megafund allocations but ideal for investors deploying smaller checks.

In this video, Adil explains how these inefficiencies create fertile ground for alpha generation, especially for market-neutral strategies that thrive in fragmented, capacity-constrained markets.

Figure 5

Source: CoinMarketCap and companiesmarketcap.com. Data obtained on August 1, 2025.

Figure 6

Source: CoinShares Digital Asset Fund Manager Survey - July 2025; data available as of close July 30, 2025.