Graphing Digital Assets

Year in Review — 2025

As we look ahead to 2025, December’s Graphing Digital Assets revisits some of our favorite data and how the markets moved throughout 2024. Will we see new patterns emerge in the coming year, particularly as the new administration takes office in the U.S.?

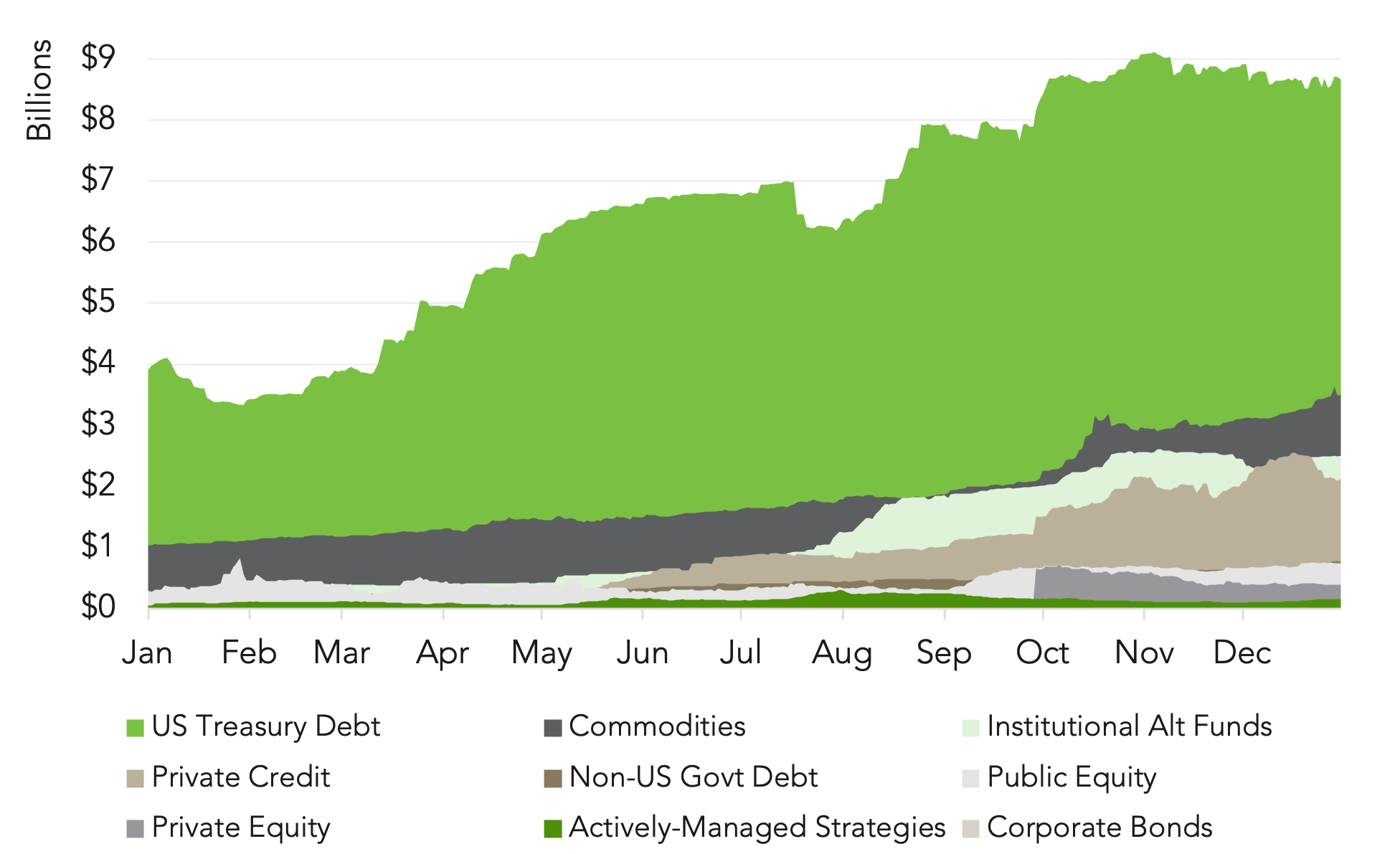

Total Tokenized Real World Assets - 2025

Enhanced regulatory clarity in the U.S. helped accelerate the growth of real-world asset (RWA) tokenization in 2025, particularly among institutions that recognize the operational and settlement efficiencies of transacting on-chain. Asset classes with historically high barriers to entry increasingly turned to tokenization as a mechanism to broaden access and improve liquidity. Total tokenized assets nearly tripled in 2025, growing from approximately $5.6 billion to nearly $18.9 billion, led by U.S. Treasury debt and commodities, followed by institutional alternatives and private credit.

Source: rwa.xyz as of December 31, 2025 (data retrieved January 2, 2026).

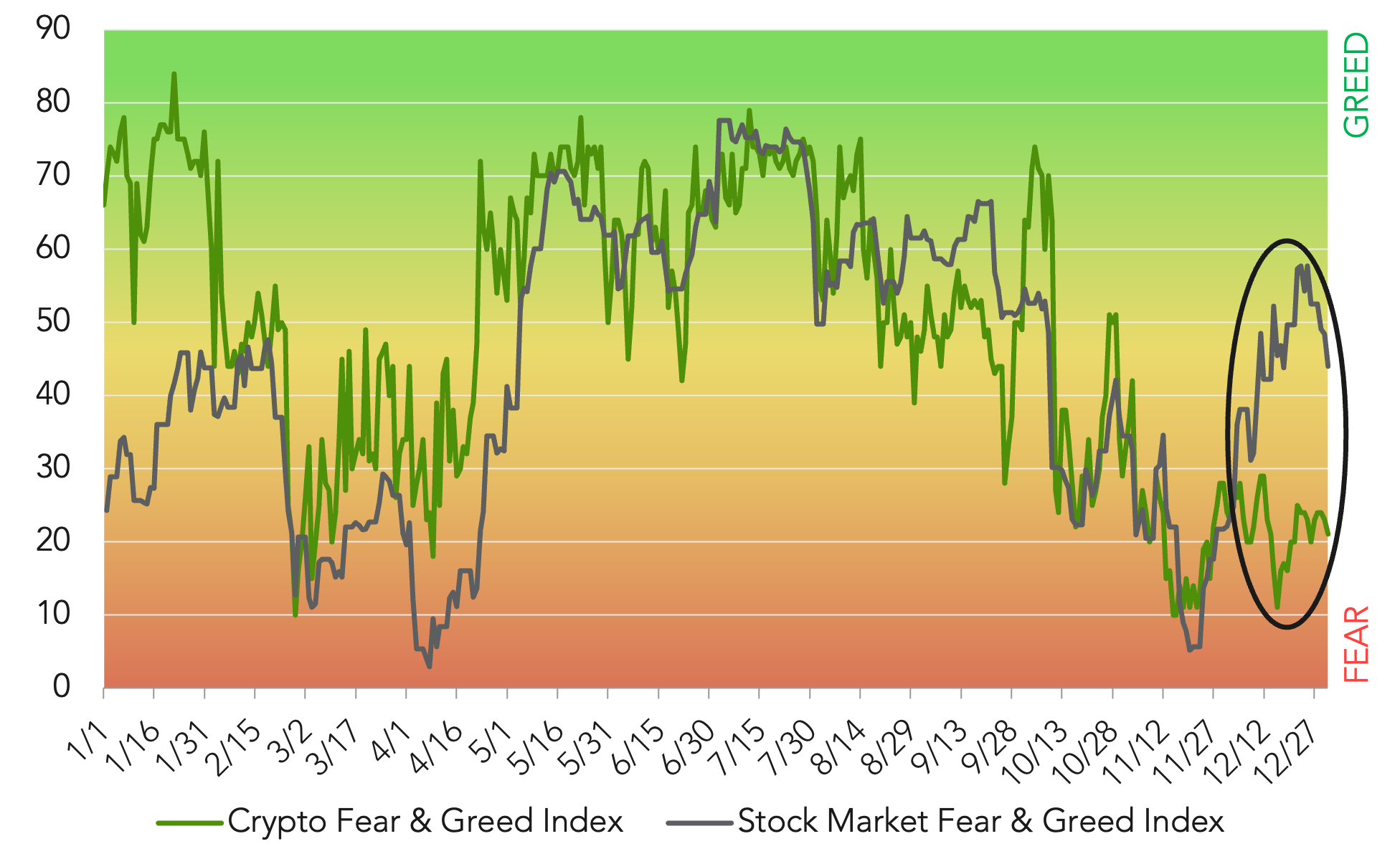

Crypto vs. Equities - Fear and Greed in 2025

Bitcoin broke $100,000 for the first time as 2025 opened, fueling bullish sentiment and renewed confidence across digital assets. Historically, crypto sentiment has skewed toward greed; however, as crypto continued its transition toward broader institutional participation, periods of convergence emerged between stock and crypto fear and greed. In the fourth quarter, a clear divergence followed: equities moved out of fear while crypto remained risk-averse, suggesting a digital asset market increasingly shaped by institutional positioning, risk management, and macro sensitivity rather than speculative momentum.

Sources: https://alternative.me/crypto/fear-and-greed-index/ & https://www.cnn.com/markets/fear-and-greed.

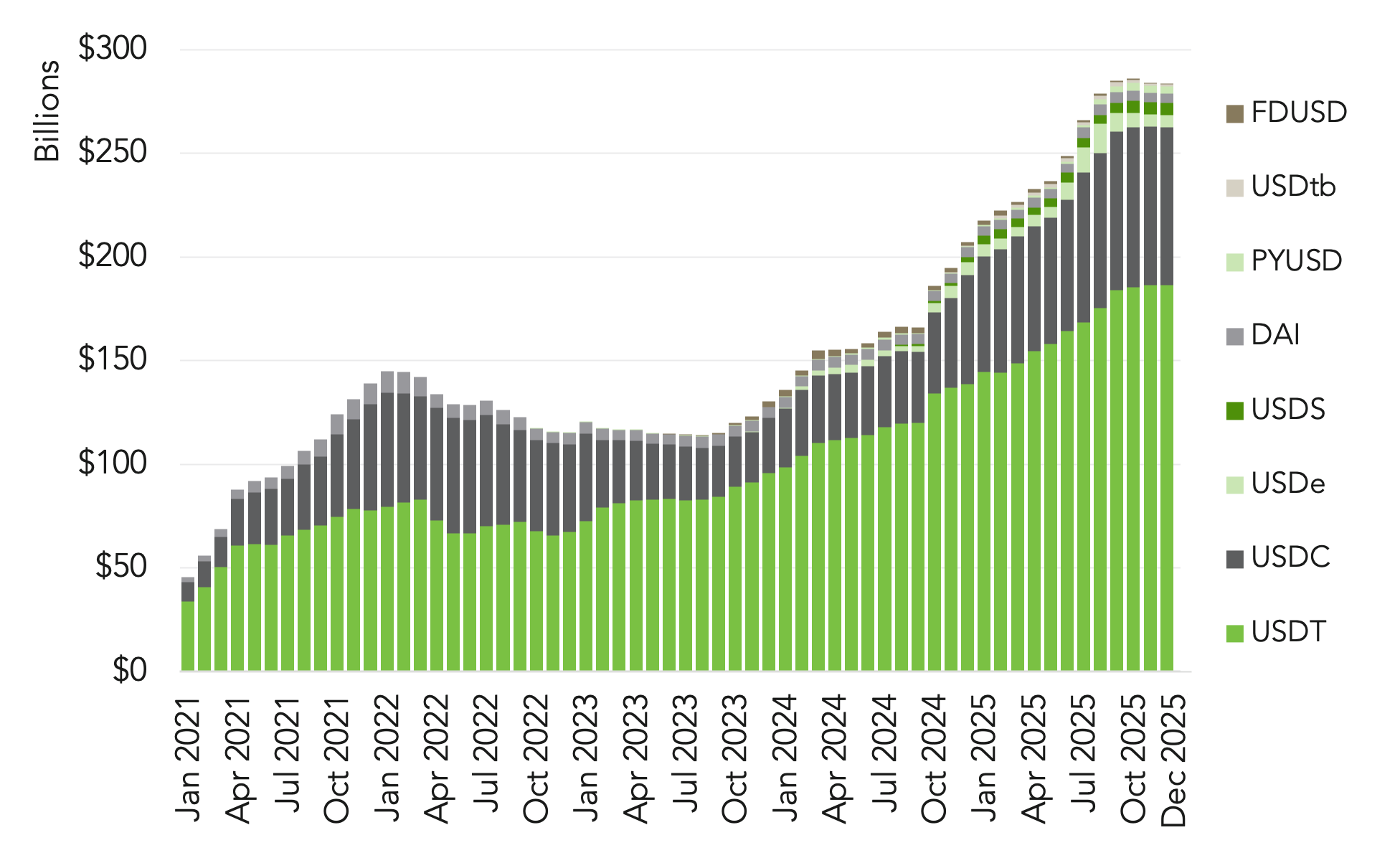

Total Stablecoin Supply

The landmark bipartisan passage of the GENIUS Act in July 2025 helped accelerate stablecoin growth in 2025, with market capitalization reaching approximately $308 billion by year-end, a roughly 50% increase year-over-year. The year also saw nearly 40% growth in stablecoin supply, alongside a sharp rise in usage, with adjusted transaction volumes exceeding $4 trillion in December alone. As stablecoin adoption continues to scale, McKinsey has estimated that annual stablecoin transaction volumes have surpassed $27 trillion and could approach traditional payment systems over the coming decade.

Sources: Artemis Analytics and DefiLlama as of December 31, 2025.

Strategy (MSTR) NAV Premium (Basic Shares) – 2025

Companies that relied on bitcoin treasury strategies to drive equity value saw those premiums compress over the course of 2025. As bitcoin’s price action shifted, early enthusiasm for BTC-heavy balance sheets gave way to more disciplined equity pricing, with firms such as Strategy (MSTR) ultimately trading at a discount to their underlying bitcoin holdings. This shift reflects growing investor scrutiny around leverage, dilution, and capital structure, underscoring that simply holding bitcoin is insufficient to create shareholder value.

Source: strategytracker.com

BTC vs. USD vs. Gold - 2025

Amidst the August unwind, we compared a surge in volatility against the historical seasonal patterns in volatility and market sentiment in prior years. Not surprisingly, macroeconomic factors have a significant effect on the Cboe Volatility Index and trading, as evident in the most recent December spike in reaction to the Fed’s hawkish messaging following the last FOMC meeting.

Source: BTC-USD, GC=F, and DXY from Yahoo Finance as of December 31, 2025.

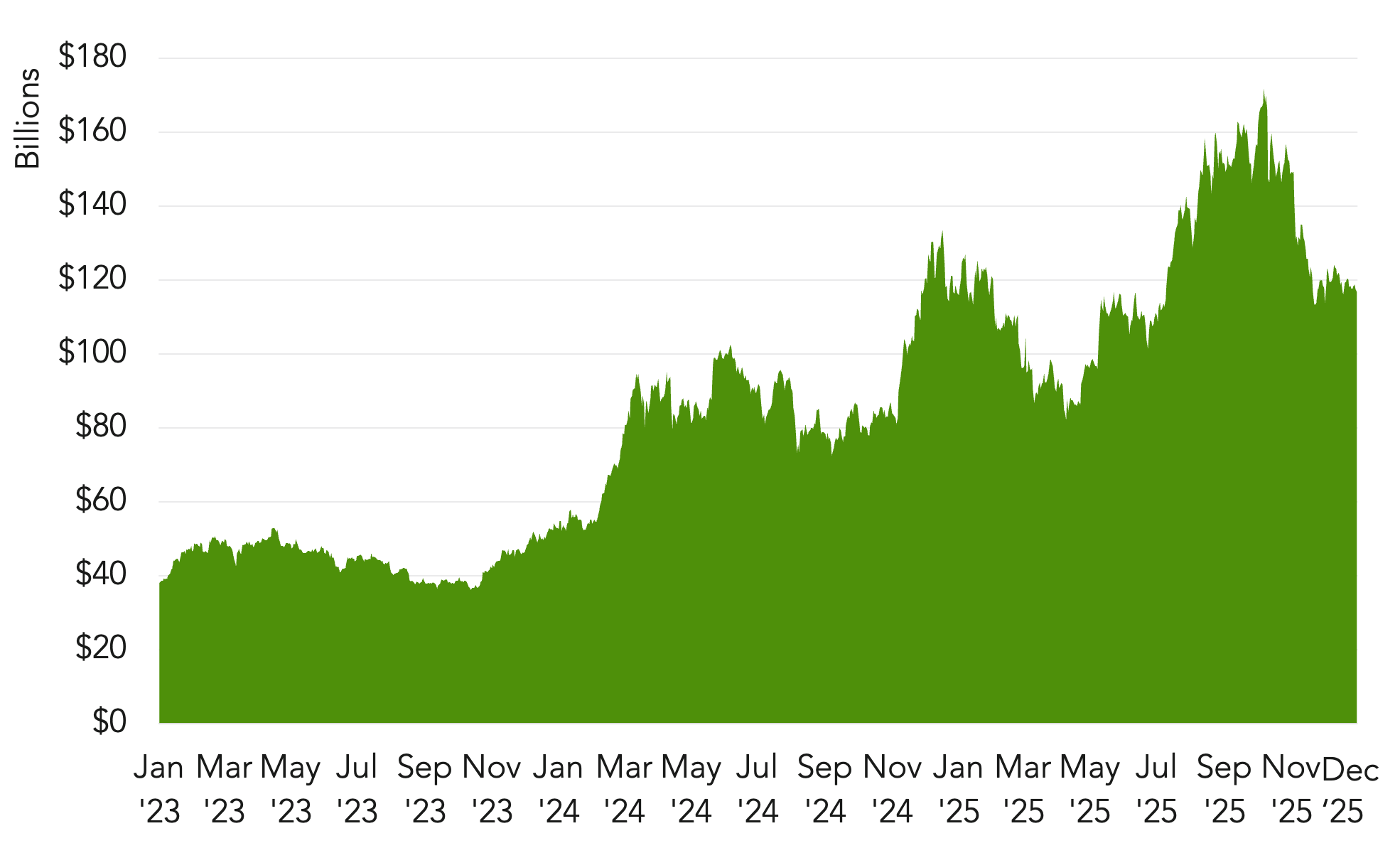

DeFi Total Value Locked (TVL)

As we move into 2025 and the Fed’s presumed hawkish stance on monetary policy, we conclude our look back on 2024 with an overview of inflation rates and how FOMC rate changes have affected inflation throughout the year. What will this mean for 2025?

Source: DefiLlama as of December 31, 2025.