Tokenized Stocks: Reimagining Capital Markets for the Digital Era

A structural analysis of tokenized equities vs traditional securities.

Sep 5, 2025Tokenized stocks are redefining capital markets by enabling equities to be issued, traded, and settled on public blockchains. Unlike traditional systems, these digital instruments offer real-time, borderless transactions, T+0 settlement, fractional ownership, and seamless DeFi (decentralized finance) integration, while preserving the economic profile of traditional securities.

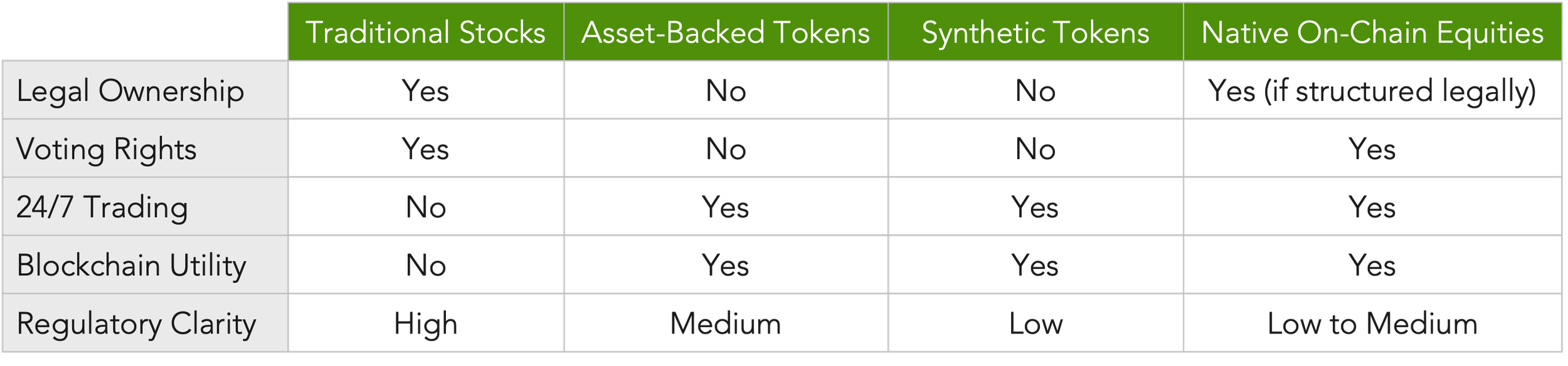

Three structures are most commonly used: asset-backed tokens, collateralized by real shares; synthetic tokens, which simulate price exposure without ownership; and native on-chain equities, issued and governed entirely by smart contracts. Each carries distinct regulatory and legal implications.

Industry leaders such as Figure Markets and Superstate are building compliant infrastructures to support tokenized equity issuance and transfer. Their platforms integrate regulated mechanisms like Alternative Trading Systems (ATS) and blockchain-native transfer agent services. With global regulatory momentum, tokenized stocks are transitioning from concept to credible infrastructure for both institutional and retail capital formation.

Defining Tokenized Stocks

Tokenized stocks are cryptographically secured representations of equity securities, issued and traded on public blockchain networks. The structure of a tokenized stock varies according to its implementation model. In some instances, the token directly represents a claim to an underlying share held by a regulated custodian. In others, it simulates the price behavior of the stock without conveying ownership rights.

Asset-backed tokenized stocks are digital tokens that mirror the value of actual shares on a strict one-to-one basis, with the real shares held by a regulated custodian. Transparency is ensured through on-chain proof-of-reserves, confirming full collateralization. Holders can redeem tokens for their cash value, though typically not for the underlying share, which remains in depositary custody under a formal agreement.

Synthetic tokenized stocks, by contrast, do not confer legal ownership or any claim on underlying shares. Instead, they mimic the financial performance of a stock using algorithmically governed smart contracts and real-time price data provided by blockchain-integrated oracles. While this model enables broader programmability and unrestricted access, it introduces potential risks related to oracle accuracy, contract vulnerabilities, and regulatory ambiguity.

The third model is native on-chain equities – equity securities that originate entirely on the blockchain. These instruments are typically used in decentralized governance structures such as Decentralized Autonomous Organizations (DAOs). They may include embedded voting rights, governance privileges, and financial incentives, all defined and enforced by smart contract logic. While this model offers maximum transparency and composability, its legal recognition depends on jurisdictional acceptance.

Comparing Tokenized and Traditional Equities

Traditional equities are issued, cleared, and settled through centralized financial institutions. Brokers, clearinghouses, and registrars serve as intermediaries, and settlement was just last year shortened from two business day after a trade is executed (T+2) to one business day (T+1). Tokenized stocks, particularly those issued as asset-backed or synthetic tokens, settle nearly instantly due to blockchain automation. Native on-chain equities, by design, are settled at the point of transaction.

Access to traditional equities is generally restricted to regulated brokerage platforms and limited to standard market hours. Conversely, tokenized stocks can be purchased, transferred, and sold 24 hours a day, seven days a week, by anyone with an internet connection and a compatible blockchain wallet. This continuous accessibility marks a significant departure from the gatekeeping mechanisms of legacy finance.

Legal rights also differ across these models. Traditional stocks convey direct ownership, voting rights, and shareholder protections. Asset-backed tokenized stocks replicate some of these economic characteristics but often lack governance rights. Synthetic tokens, while economically expressive, do not provide ownership or voting privileges. Native on-chain equities may offer governance capabilities through token mechanics, but the enforceability of such rights depends on applicable laws and regulatory acceptance.

From a regulatory perspective, traditional equities enjoy the highest degree of legal clarity. Asset-backed models are increasingly recognized within the existing legal framework for securities. However, synthetic and native models remain under heightened scrutiny due to their departure from conventional ownership constructs.

The core trade-off is clear: while traditional stocks provide greater legal certainty, tokenized models offer unmatched operational flexibility, global accessibility, and design innovation.

Here we illustrate a generic structure of asset-back token:

Capital Efficiency and DeFi Integration

Tokenized equities derive significant utility from their composability within decentralized financial ecosystems. Once tokenized, an equity asset is no longer restricted to passive ownership. It can serve as collateral in lending protocols, be deployed into automated market-making (AMM) liquidity pools, or be incorporated into structured financial products that generate yield.

For example, TSLAx, a tokenized version of Tesla stock issued by Backed Finance, can be deposited into the Kamino Finance protocol to secure loans in the form of stablecoins or to earn staking rewards. This redefines equities from static instruments into dynamic financial primitives capable of participating in broader on-chain economies.

Experts note that tokenization is poised to accelerate settlement, expand access, and ultimately transform the process by which capital is raised, allocated, and exchanged, having foundational systemic implications.

The Global Regulatory Landscape

In the United States, the Securities and Exchange Commission (SEC) has affirmed that tokenized stocks fall under the regulatory purview of the Securities Act of 1933 and the Securities Exchange Act of 1934. Platforms seeking to offer these instruments must either register with the SEC or qualify under applicable exemptions. The GENIUS Act, signed into law in July 2025, establishes a framework for fully reserved, compliant payment stablecoins. While the statute does not directly govern tokenized equities, it underscores Congressional momentum toward broader digital asset regulation in the U.S.

In the EU, the Markets in Crypto-Assets (MiCA) regulation now provides the overarching framework for digital assets, though some tokenized equity pilots still operate under MiFID II exemptions and sandboxes. Backed Finance, regulated in Switzerland, issues tokenized equities such as TSLAx and AAPLx under a MiFID II-compatible framework.

In Asia, jurisdictions like Singapore and Hong Kong have adopted innovation-forward stances. The Monetary Authority of Singapore (MAS) and the Securities and Futures Commission (SFC) in Hong Kong have both established sandbox environments for testing tokenized financial products, including programmable equity instruments.

Why Tokenized Stocks Are the Future of Trading

Tokenized equities solve key problems in traditional markets:

Access: Anyone with internet access and a crypto wallet can participate.

Time: Trading is no longer restricted to business hours.

Cost: Tokenization removes layers of intermediaries and lets you invest in amounts as small as $5.

Speed: Settlement occurs instantly with no waiting days for trade confirmation.

Consider this practical illustration of tokenized trading:

A retail investor is seeking exposure to Tesla stock valued at one hundred dollars. Using a tokenized infrastructure, this individual could purchase TSLAx on a tokenized exchange such as Kraken, transfer the token to a Phantom Wallet for self-custody, stake the asset on Kamino Finance to generate yield or collateralize a loan, and later liquidate the position on a decentralized exchange such as Raydium. This entire process can occur within minutes, at any hour, and without reliance on a traditional brokerage.

This stands in stark contrast to the conventional trading experience, where the same transaction would involve brokerage fees, market-hour limitations, and a delayed T+1 settlement cycle.

These benefits go even further when you plug tokenized stocks into DeFi protocols. They can be used as collateral, generate yield, or be paired in liquidity pools.

Risks and Considerations

Despite their advantages, tokenized stocks are not without risk. In many cases, tokenized equities do not confer voting rights or direct ownership claims. There are also technical vulnerabilities inherent in smart contracts and oracles, including potential manipulation or code exploits. Regulatory clarity remains inconsistent across jurisdictions, and some asset-backed models are dependent on the solvency and integrity of the custodians holding the underlying shares. Additionally, early-stage decentralized exchanges may experience low liquidity, leading to liquidity dislocations and pricing inefficiencies during large transactions.

Tokenized stocks face unique market risks. Because redemptions are tied to off-chain stock prices, weekend or after-hours price rallies on-chain can quickly reverse when traditional markets reopen, causing losses. Liquidity also tends to dry up during weekends and volatile after-hours periods as institutional players step back, leading to heightened volatility and abrupt repricing. If these assets are used as DeFi collateral, sudden price drops coupled with low liquidity can trigger potentially systemic liquidations across DeFi protocols. Investors should note that tokenized equities are subject to evolving regulation, and access may be restricted based on jurisdiction.

The Outlook for Tokenized Capital Markets

The future of tokenized equities appears increasingly institutional. As both regulatory clarity and technical infrastructure mature, broker-dealers in the United States are likely to enter the market with offerings that include tokenized private equity and exchange-traded funds (ETFs). Yield-generating equity wrappers, cross-chain interoperability, and sovereign recognition of blockchain-based share registries will likely follow.

Samara Alpha Management, a pioneer in DeFi-native hedge fund strategies, has been at the forefront of integrating tokenized securities into decentralized finance ecosystems. By combining hedge fund risk management techniques with blockchain-based instruments, Samara Alpha demonstrates how tokenized equities can serve as both yield-generating collateral and programmable assets within structured DeFi portfolios. This trend is exemplified by our recent partnership with SBI Digital Markets and Bracket Labs, which reflects institutional demand for regulated, DeFi-integrated tokenized securities infrastructure.

Conclusion

Tokenized stocks mark a departure from the rigid systems of the past. By marrying blockchain-native capabilities with institutional-grade compliance, these instruments offer a blueprint for the next generation of global financial infrastructure. Far more than a technological novelty, tokenized equities have the potential to redefine how value is created, transferred, and governed. The convergence of blockchain programmability and institutional compliance suggests tokenized equities are not a passing experiment, but a durable evolution in capital markets.

Originally authored by CEO Wilfred Daye, a version of this article was published on Coinspaidemedia.