Graphing Digital Assets

Month in Review — June 2025

Signs of Maturity Amid Geopolitical Turmoil

Markets ended the first half of 2025 on stable footing, with modest gains across major asset classes. The S&P 500 TR ended June at a new record high, up 5.09% for the month, while gold peaked at a YTD high of $3,444 on June 13, then finished the month essentially flat. Bitcoin reached a monthly high of $110,561 on June 9, finishing June +2.39%, with YTD gains of 14.67%, a strong showing that reflected resilience even as broader market momentum cooled.

June also marked the start of a historically quieter period for digital assets. In keeping with the “sell in May and go away” effect, BTC and ETH traded largely sideways throughout June, despite geopolitical tensions escalating in the Middle East that just months earlier might have triggered broader market reactions.

As bitcoin and gold reached their monthly highs, talks of conflict erupted between Iran and Isreal. Israeli airstrikes on Iran on June 13 were followed by a U.S. missile strike on June 21, with a ceasefire agreement reached on June 24. As illustrated in Figure 1, while markets remained relatively composed over the trading days since June 13, the contrast in performance is notable. Gold, often viewed as a geopolitical hedge, sold off from its highs, likely due to fading risk premiums or position unwinds. Bitcoin, meanwhile, absorbed the shock and traded with uncharacteristic stability in the days that followed.

Cumulative returns for the month (Figure 2) further clarify the divergence. Gold posted strong early-month gains but reversed sharply after June 13, finishing the month in negative territory in terms of cumulative returns. The S&P 500 showed somewhat resilience, and bitcoin, after giving up early gains, rebounded into the end of the month, closing higher despite headline risk.

This contrast in behavior highlights a broader evolution in bitcoin’s role, marking a subtle but meaningful shift in how the digital asset behaves under greater macro stress. While previously regarded as a highly reactive risk asset, its current price action suggests growing maturity. Its muted response to headline risk may reflect an increasingly stable investor base, growing institutional ownership, and the influence of spot ETFs.

Whether this resilience holds in more volatile conditions remains to be seen. But in June, bitcoin didn’t just avoid the noise; it outlasted it.

Figure 1

Figure 2

Source: Samara Alpha Management and Yahoo Finance. Bitcoin price reflected in USD terms. Gold represented by GLD.

Stablecoins: The Road to Onboarding a Billion

We continue our coverage of the stablecoin landscape, building on last month’s exploration of institutional adoption and regulatory momentum. In June, stablecoin market capitalization surged to an all-time high of $253.6 billion, propelled by growing utility and advancement of key legislation, including the STABLE Act and GENIUS Act.

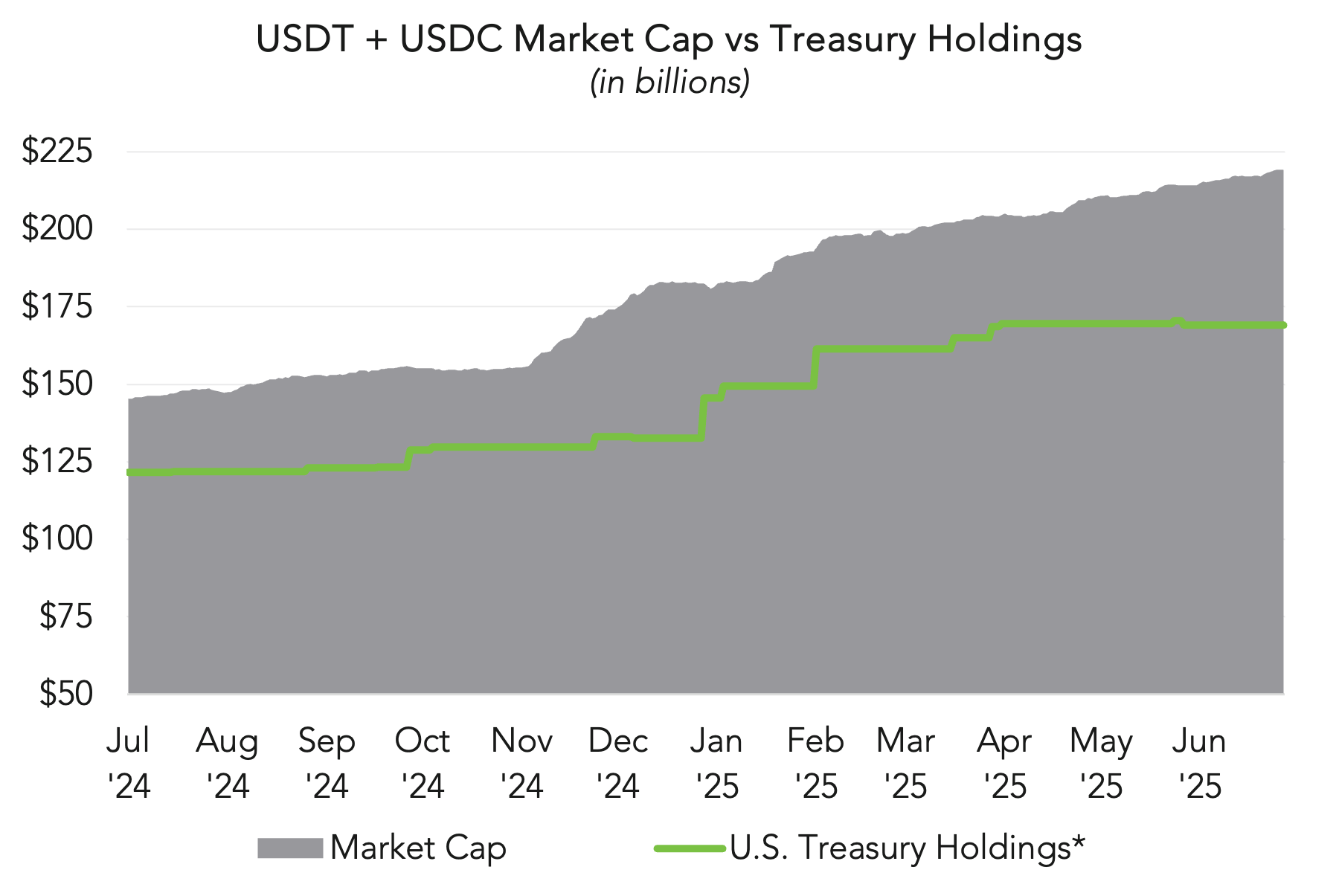

Leading issuers Tether and Circle reached a combined $219.3 billion market cap, underscoring stablecoin’s participation in U.S. financial markets. These stablecoins have shown steady growth over the past year and, as market capitalization has increased, so has the amount held in U.S. Treasuries (Figure 3). With an estimated 80% of reserves held in short-term Treasuries and repos, Tether and Circle collectively hold nearly $170 billion in U.S. government debt, ranking them among the top global holders.

Concurrently, real-world usage is accelerating. A report by Artemis and Castle Island Ventures found that stablecoin payments are now running at a $72.3 billion annual pace, excluding trading activity. The dominant use case is business-to-business (B2B) transfers, now the largest share of payment flows, highlighting growing enterprise adoption for cross-border settlements, invoicing, and treasury operations.

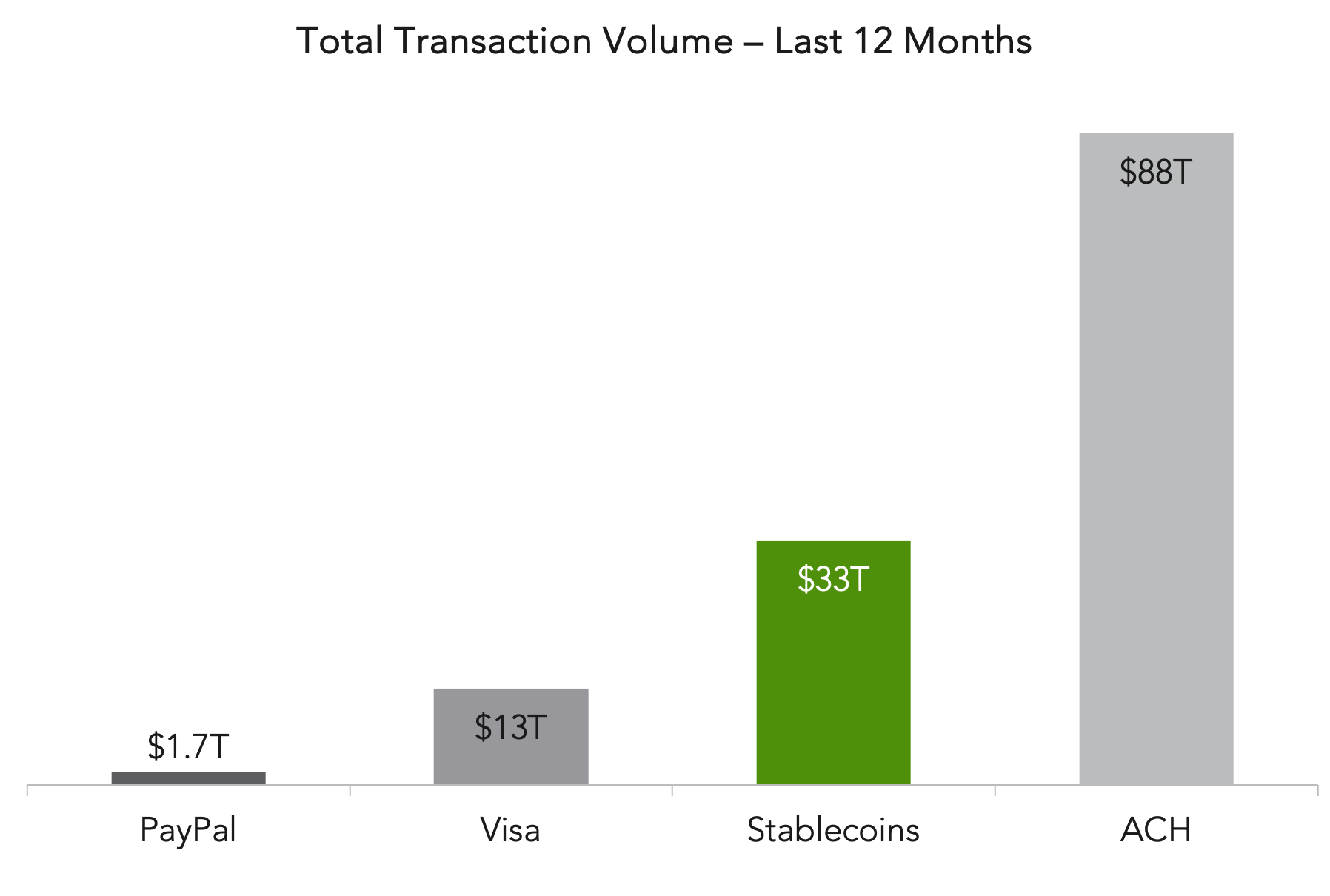

The scale is rivaling traditional financial networks. According to a16zcrypto research, stablecoin transaction volume is nearly 20x that of PayPal, 2.5x Visa, and on a trajectory towards approaching ACH transactions (Figure 4). These digital dollars are becoming foundational infrastructure, positioned as “the first credible opportunity to onboard a billion people into crypto.”

With clear regulatory frameworks taking shape, increasing real-world adoption, and a growing role in global debt markets, stablecoins are emerging as a powerful bridge between the traditional and digital financial systems.

Figure 3

Sources: www.tether.to and www.circle.com transparency reports.

*Tether audited reports published quarterly, with last available Reserve data updated as of March 31, 2025.

Figure 4

Source: a16zcrypto, Paypal, Visa, Nacha as of May 31, 2025, latest reported data.

HNW Investors Demand Digital Asset Expertise

CoinShares’ 2025 Advisors Survey, released in June, underscores a rising tide of interest in digital assets among wealthy investors, but also highlights persistent barriers to full adoption.

The study surveyed 500 high net worth (HNW) and sub-HNW investors, revealing that 90% of current digital asset holders plan to increase their exposure this year. More than half monitor or trade digital assets daily, suggesting digital asset investing has moved from speculative curiosity to a core component of modern portfolio strategy.

Investor motivations are broad-based. While most respondents cite high return potential, others are drawn to long-term capital appreciation, blockchain innovation, or portfolio diversification (Figure 5). This diversity of intent supports the view that crypto’s appeal spans beyond price action alone. In fact, of respondents who have not yet invested in digital assets, 54% are most attracted by portfolio diversification, while 39% to the potential for long-term capital appreciation.

Yet despite this growing enthusiasm, many investors question whether their financial advisors are equipped to guide them. Nearly one-third cited concerns about advisor credibility and transparency around digital asset risk, a trust gap that remains a critical hurdle to broader institutionalization. While 88% of crypto holders already work with a financial advisor, 82% said they’d be more inclined to engage one if digital asset guidance were offered. Over half of respondents would actively seek out professionals who can educate them, and 55% consider digital asset expertise “extremely important” in their selection criteria.

The report also sheds light on investor preferences for regulated access points. ETFs and trusts were the most commonly used vehicles (28%), outpacing centralized exchanges (21%), as investors gravitate toward more secure investment structures. Brokerage platforms offering digital assets (24%) and custodial platforms through advisors (16%) also ranked highly, reinforcing the demand for institutional-grade infrastructure.

For advisors and managers, the message is clear: digital asset adoption is accelerating, but so are expectations. Investors want thoughtful, compliant pathways into the space and advisors who can match conviction with credibility.

Figure 5

Figure 6

Source: CoinShares Advisors Survey, 2025: “Affluent individuals & crypto: what do they really want?” Published June 2025.