Beyond Stablecoins: The Rise of Tokenized Cash

Institutions are shifting to this digital representation of fiat currency, enabling faster and more efficient payments and settlements.

Jul 30, 2025

Stablecoins brought dollars onto blockchains, unlocking 24/7 payments, DeFi access, and faster settlement without banks. But tougher regulations and institutional demands are exposing their limits. The market is now shifting toward something more robust: tokenized cash.

Issued by banks, FinTechs, and government institutions, these fiat-backed assets are fully compliant and settle in real time on blockchain rails. In this article, we break down why the shift is happening, what infrastructure it needs, and what its implications are for Defi, TradFi, and global finance.

Limitations of Stablecoins

Stablecoins solved an early challenge: volatility. Pegged to the dollar, they created liquid, reliable rails for 24/7 payments, DeFi lending, and cross-border payments.

Since 2019, the stablecoin market has grown from approximately \$6 billion to nearly $275 billion. Tether alone accounts for roughly 60% of that market, making it the dominant liquidity provider across exchanges. [1]

While reserves have historically raised questions, major issuers are responding with increased transparency. Both Tether and Circle publish regular attestation reports, and the GENIUS Act (passed on July 18, 2025) formalizes regulatory requirements for stablecoins, among them reserve backing, redemption rights, and issuer licensing. These developments represent meaningful progress toward institutional-grade compliance and oversight.

However, liquidity remains fragmented, a characteristic of the broader digital asset market. The presence of multiple stablecoins divides market depth and can lead to pricing inefficiencies across platforms.

As stablecoins continue to evolve under tighter regulatory guardrails, the market is increasingly looking to tokenized cash — fully integrated with traditional finance — to address the next layer of limitations: interoperability, composability, and on-chain settlement at scale.

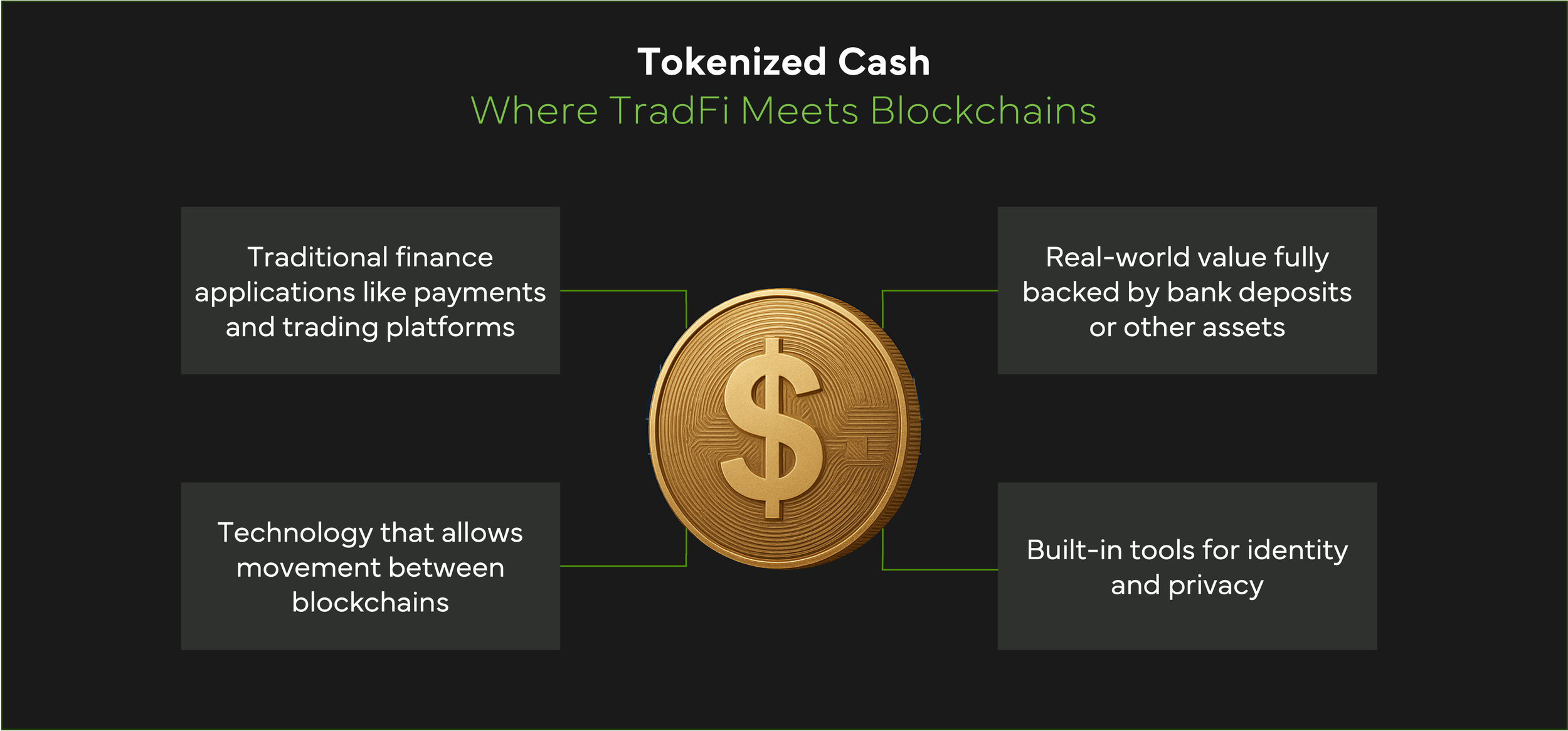

What is Tokenized Cash?

Tokenized cash is not just backed by fiat — it is fiat, issued and settled on-chain by regulated financial institutions. Unlike stablecoins, these tokens represent a direct claim on deposits, treasuries, or regulated money-market instruments, and are fully redeemable at par.

One of the first to launch was BENJI, Franklin Templeton’s tokenized U.S. Government Money Fund, the first U.S.-registered mutual fund to record ownership and process transactions on public blockchains. Live on Ethereum, Solana, and Base, BENJI distributes yield daily and complies fully with SEC rules.

Today, however, the most notable leader is BlackRock’s BUIDL, a tokenized money market fund launched in 2024 that has grown to more than $2.4 billion in assets under management. Built on Ethereum and now live across multiple chains, BUIDL has become the de facto standard for tokenized cash equivalents, demonstrating institutional demand for secure, transparent, yield-bearing digital assets.

This new generation of tokenized assets blends the legal structure of traditional finance with the programmability and speed of public blockchains. These tokens don’t need to sidestep regulation — they’re designed to operate within it, offering trusted rails for institutions and programmable liquidity for decentralized ecosystems.

From Clarity to Capability: The Rise of Tokenized Cash

Regulation

On July 18, 2025, the GENIUS Act was signed into law in the United States, establishing the first federal regulatory framework for stablecoins. This landmark legislation defines the rules for “payment stablecoins” and lays the foundation for trusted, compliant digital fiat. Under the Act:

Only regulated banks and trust companies, known as Permitted Payment Stablecoin Issuers (PPSIs), may issue payment stablecoins.

Issuers must maintain 1:1 reserves in cash or U.S. Treasuries, publish monthly attestations, and comply with AML/KYC regulations.

Algorithmic stablecoins are banned.

Big Tech platforms are prohibited from issuing digital money.

The law goes into effect either 120 days after final rule-making or January 18, 2027, whichever comes first. This legal clarity has catalyzed a new wave of institutional engagement.

Institutional Traction

For institutional players, tokenized fiat is not just a blockchain experiment—it’s a strategic enabler. Unlike stablecoins, which were designed primarily for crypto-native use cases, tokenized cash offers regulated exposure, daily yield, and compliance-aligned settlement.

Treasury teams benefit from 24/7 liquidity and programmable disbursements. Fund managers gain a composable, lower-risk asset class for on-chain operations. And compliance officers can leverage auditability without compromising confidentiality, thanks to privacy-preserving infrastructure.

These functional advantages—not just regulatory clarity—are accelerating institutional alignment. Tokenized fiat isn’t replacing stablecoins; it’s extending their utility in a way that finally meets institutional standards.

Central Banks and Global Infrastructure Efforts

As of mid-2025, more than 130 jurisdictions, representing more than 98% of global GDP, are exploring central bank digital currencies (CBDCs). Eleven projects are already live with dozens more in advanced pilot stages, signaling global interest in fiat instruments that can move and settle natively on blockchain rails.

It is worth noting that while many global jurisdictions are advancing CBDC initiatives, U.S. policy has taken a more cautious stance, particularly on retail issuance. In July 2025, the Anti‑CBDC Surveillance State Act passed in the House, prohibiting the Federal Reserve from issuing a retail CBDC without explicit congressional approval. Driven by privacy and surveillance concerns, the bill reflects domestic resistance to a government-issued, consumer-facing digital dollar, while still supporting private-sector innovation in tokenized money market funds and bank-issued digital instruments.

Concurrently, global financial infrastructure is evolving. Institutions such as the DTCC, BIS, and regional regulators are piloting tokenized government securities, cross-border settlements, and institutional-grade custody frameworks. These efforts reinforce the need for interoperable, standards-based infrastructure to support tokenized fiat and related digital assets.

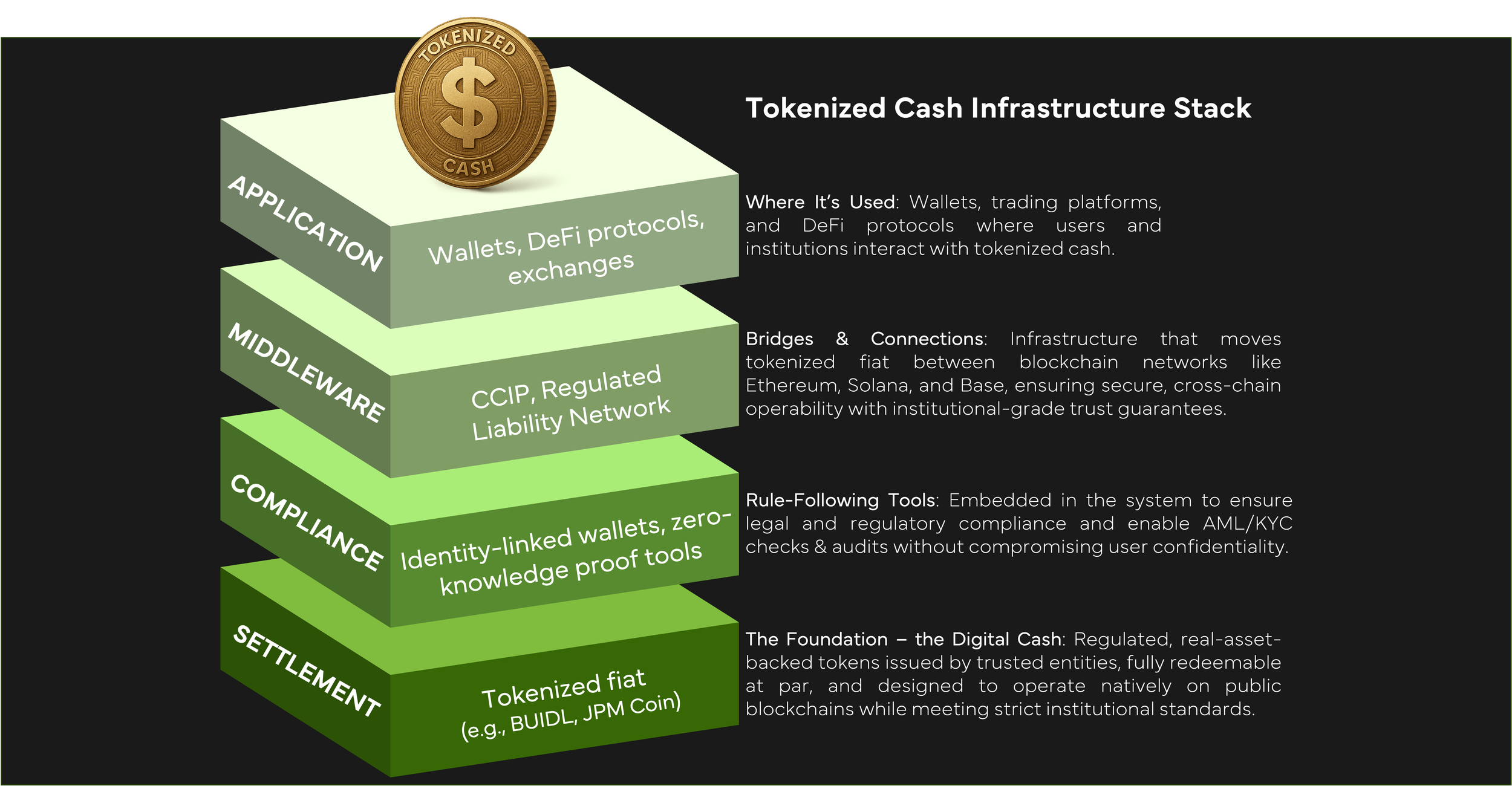

Building the Infrastructure for Tokenized Cash

Tokenized cash is more than a digital dollar. It’s an entirely new operating system for money—programmable, composable, and embedded into decentralized finance rails. But to succeed at scale, it requires robust infrastructure that supports compliance, privacy, interoperability, and usability.

At the core of this infrastructure are four critical components:

Identity-aware wallets. In permissioned environments, wallets must be linked to verified identities. Integrating KYC and AML checks into the wallet layer—via providers like Sumsub or Parallel Markets—allows issuers to maintain compliance without relying on intermediaries.

Interoperability across chains. Tokenized fiat won’t live on a single blockchain. Institutions already operate across Ethereum, Solana, Base, and Layer 2 networks like Arbitrum and Optimism. Secure interoperability solutions like Chainlink’s CCIP and the Regulated Liability Network (RLN) are enabling cross-chain settlement with institutional guarantees.

Privacy, redefined for compliance. Full on-chain transparency isn’t practical for sensitive financial transactions. Instead, institutions are adopting zero-knowledge proofs and selective disclosure mechanisms that allow for confidential transactions while preserving auditability for regulators and counterparties.

Seamless ecosystem integration. Tokenized fiat needs broad compatibility with existing infrastructure. That includes exchange listings, wallet support (e.g., Fireblocks, BitGo), fiat onramps, and integration with DeFi protocols. Without utility at the point of use, tokenized fiat risks becoming a back-office tool rather than a foundational asset class.

The Convergence of Regulation and Technology

The combined effect of regulatory clarity and advancing infrastructure is redefining the way money moves through financial systems. Stablecoins sparked the first wave of innovation, but their limitations—especially around compliance, transparency, and interoperability—are now being addressed head-on.

Tokenized cash is emerging as the solution: a regulated, programmable, and scalable form of digital fiat that bridges the gap between TradFi and DeFi. With the right infrastructure in place, it has the potential to anchor the next phase of the global financial system.

Why It Matters

Tokenized cash represents the next phase in the institutional evolution of digital assets. While stablecoins played a critical role in onboarding users and capital into early DeFi systems, their limitations—particularly around compliance, interoperability, and yield—have opened the door to a new class of programmable, regulated assets.

In DeFi, tokenized cash introduces lower-risk collateral and real-world asset rails that support credit, liquidity provisioning, and composable financial contracts. In traditional markets, it enables 24/7 settlement, automated treasury operations, and enhanced transparency across the financial stack. For policymakers, it offers new tools for reducing friction, enhancing oversight, and improving the efficacy of monetary policy.

More broadly, tokenized cash is reshaping the digital asset ecosystem. It consolidates fragmented liquidity around regulated, interoperable instruments; enables new market primitives, such as interest-bearing, composable collateral; accelerates asset onboarding at scale, including tokenized Treasuries, credit, and real estate; and lowerw the barriers to institutional adoption, through compliance-first design and public blockchain interoperability

Stablecoins helped lay the foundation. Tokenized fiat is not just where traditional capital meets programmable infrastructure—it’s the foundation for the next evolution in global finance.

[1] Source: CoinMarketCap as of July 29, 2025.